The high-priority bands include 600MHz and 28GHz mmWave spectrum

The Canadian government has published its playbook for the next five years of wireless spectrum releases. Considering both international developments and domestic demand, the 2018-2022 outlook plots a course for when certain high-priority spectrum bands may be auctioned off to wireless operators like Bell, Telus and Rogers.

Spectrum: a valuable and limited resource

While invisible to the naked eye, radio spectrum is one of the most valuable and in-demand resources in Canada. It’s used for a number of purposes — from radio broadcasts to voice communication between aircraft — but cellular communications is by far the dominant use case in today’s increasingly mobile marketplace. What’s more, it’s a fixed resource; there’s only so much spectrum available within certain ranges of frequencies, and carriers like Bell, Rogers, Telus and Freedom Mobile have to compete with each other to gain spectrum blocks in auctions that bring in millions, if not billions, of dollars for the government.

The outlook in broad strokes

Spectrum for the nascent fifth generation of wireless technology, 5G, is the main focus of the outlook. 5G will bring multi-gigabit speeds and reduce latencies to sub 5-milliseconds, with the first large-scale trials and deployments expected to begin next year. Cost efficiencies and a technique called network slicing that differentiates service based on use cases are also expected to be a boon for the Internet of Things (IoT), facilitating more connected devices (from toothbrushes to traffic lights) than ever before.

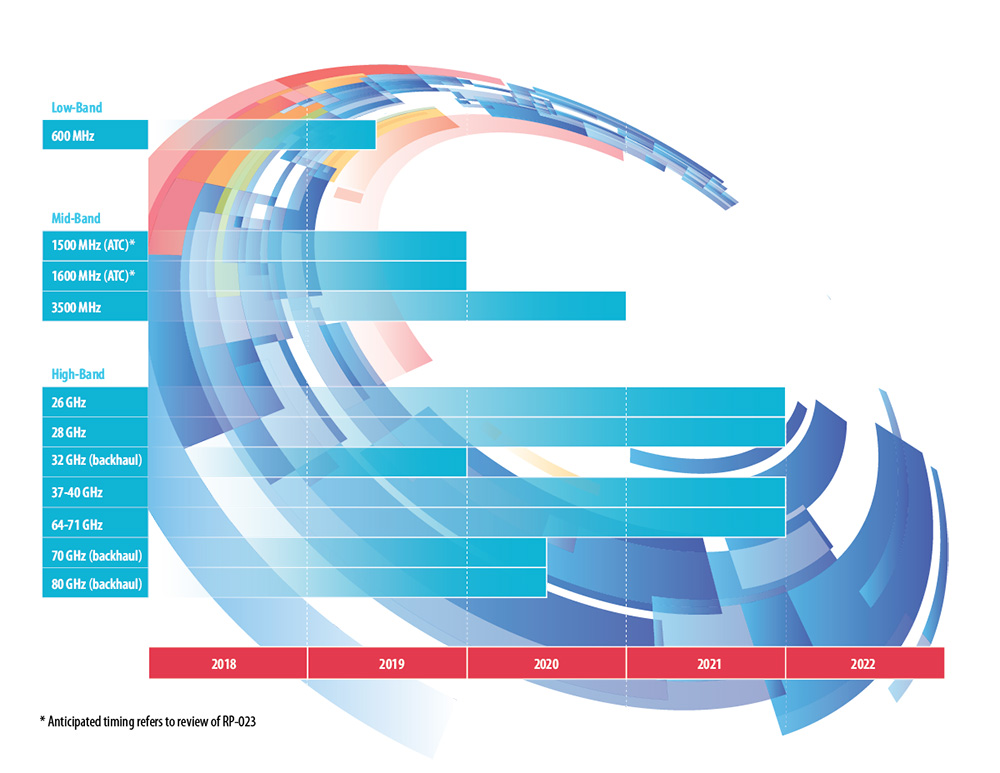

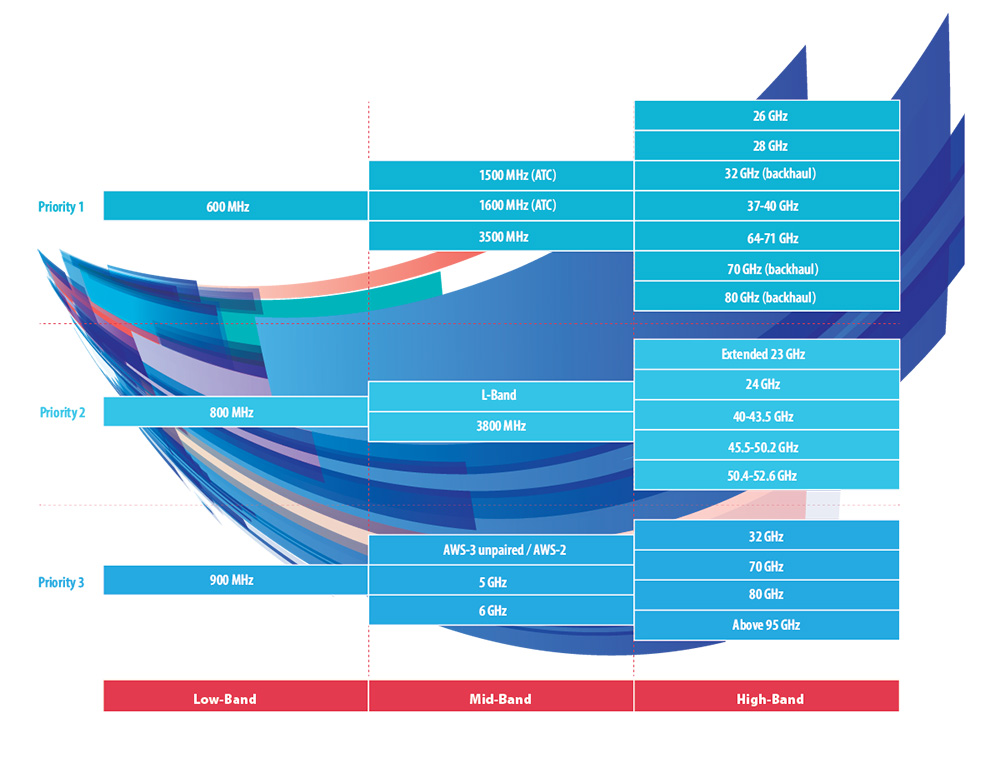

The carriers, naturally, are eager to snatch “beachfront property” in the form of in-demand 5G spectrum blocks. 3.5GHz is of the highest concern, and was addressed not only in the spectrum outlook but in a separate announcement today, in which the minister launched a 3.5GHz auction consultation to culminate in a 2021 auction. Samer Bishay — CEO of Iristel, Ice Wireless and Sugar Mobile — told MobileSyrup he hopes the government decides to set aside some of the spectrum for smaller players like his businesses, apart from the allotments up for grabs by Rogers, Bell and Telus. The Big Three, however, disagree with this point of view, and have said as much in the consultation process. The incumbents stated that Shaw (owner of Freedom Mobile) and Quebec-based Videotron, both of which would benefit from set-aside spectrum, don’t need preferential treatment due to their size. Aside from 3.5GHz, ISED ranked the following spectrum bands as “Priority 1,” outlining releases for each by 2021: 600MHz [2019] 1500MHz (ATC) [2019] 1600MHz (ATC) [2019] 3500MHz [2020] 26GHz [2021] 28GHz [2021] 32GHz (backhaul) [2019] 37-40GHz [2021] 64-71GHz [2021] 70GHz (backhaul) [2020] 80GHz (backhaul) [2020] Less in-demand spectrum, or spectrum that is still developing internationally, was also identified, including 800MHz and L-Band in the ‘Priority 2’ group and 900MHz and AWS-3 unpaired / AWS-2 in the ‘Priority 3’ group — much of which will not enter consultations before 2022.

License-exempt, satellite and backhaul

ISED’s lengthy document also touches on spectrum for licence-exempt devices, such as Wi-Fi and IoT devices, noting that the federal department will seek to identify opportunities to release additional bands for licence-exempt use in order to address market demand. Further, ISED expects to address demand and technical advances in satellite systems by launching consultations on making additional spectrum available and improving access for satellite services. ISED also recognized the demand for wireless backhaul, which generally refers to data hauled from consumer sites to the primary network backbone, noting it would make backhaul available through flexible-use licensing of commercial bands or new spectrum releases. For more details on planned spectrum releases within the next five years, find the outlook document in the source link below.

Source: ISED

Read more at MobileSyrup.com: Canadian government plans 5G future with 2018-2022 spectrum release timeline